What Is a Certificate of Insurance & Why Is It Important?

A certificate of insurance (COI) is a document or form that summarizes a company's current insurance policies. A COI is issued by an insurance company or broker and it includes insurance policies, expiration dates, coverage limits, and other pertinent insurance details.

Just like auto liability policies provide insurance cards, certificates of insurance (COIs) accompany business insurance policies. These documents contain all important aspects of your policy, and they help show an active insurance status, manage risks effectively, and allow for quick reference. A certificate of insurance acts as a summary of your business insurance coverage, showing that your business is adequately insured. It's common for potential clients to request a COI before engaging in business with you, to check that your company has the proper insurance requirements met.

COIs provide a snapshot of your insurance policy in one single form, which includes these important aspects:

- Policyholder's Name

- Policy Effective & Expiration Dates

- Type of Coverage

- Policy Limits

- Policy Carrier

What Is an ACORD Certificate of Insurance?

ACORD stands for "Association for Cooperative Operations Research and Development"

( ACORD). ACORD is a global nonprofit organization that develops and maintains standardized forms and data standards for the insurance industry.

These standardized forms and data standards created by ACORD are widely used by insurance companies, agents, brokers, and others to communicate and streamline processes such as policy issuance, claims processing, and data exchange between various parties within the insurance ecosystem.

ACORD's standards cover a wide range of insurance-related activities, including property and casualty insurance, life insurance, reinsurance, and more. One widely recognized and used ACORD form is the ACORD 25. The ACORD 25, also known as the "Certificate of Liability Insurance," is a widely used document that summarizes liability insurance coverage for a business. The ACORD certificate of liability insurance helps streamline the process of verifying insurance coverage by providing a standardized format that is recognized and accepted across the insurance industry. It may be requested by clients, banks, mortgage companies, or equipment leasing companies to ensure that the business has the necessary insurance for a project or property.

There are many different types of ACORD certificates and forms. Several other forms include:

- Certificate of Property Insurance (ACORD 24)

- Evidence of Property (ACORD 27)

- Evidence of Commercial Property Insurance (ACORD 28)

- Additional Remarks (ACORD 101)

When we discuss COIs we are typically referring to the ACORD 25 certificate, which specifically addresses liability insurance.

How Do You Read a Certificate of Insurance?

Reading a certificate of insurance might seem tricky at first, but it's easier once you understand the basics. Let's break down some of the most common terms you'll notice on a COI -especially on an ACORD 25 COI - and understand what they mean. Here's how to read a certificate of insurance:

Check out our Certificate of Insurance Walkthrough video and grab the sample COI provided below! For easy reference, we're using the Accord 25 form in our video because it's the most common form.

Feel free to watch the video above and download this sample coi below:

- Producer: The insurance agent or broker who supplied the policy

- Insured: The person, organization, or entity covered by the policy. Otherwise known as the “named insured.”

- Additional Insured: These endorsements cover people or entities in the event of claims and negligent acts. These parties usually have some degree of liability because of their relationship to the named insured.

- Coverages: Outlines the policies issued to the named insured

- General Liability: Covers liability if a business is sued for incidents that occur on its property, during or after completed operations, or because of its products

- Occurrence: One type of coverage protecting parties from incidents occurring during the policy period, regardless of when the claim is reported

- Claims-Made: Another type of coverage for claims that occur and reported within the policy period

- General Aggregate: The total amount an insurer is obligated to pay in a single term. They can respond in three ways: per policy, per project, and per location.

- Per Policy: The maximum amount an insurer pays for the total of all claims covered by an insurance policy

- Per Project: Limits applying to each of the policyholder’s projects (commonly used by building and retail store owners)

- Per Location: Limits applying to each of the policyholder’s locations (commonly used by companies and contractors doing project work, such as in construction trades)

- Automobile Liability: Covers policyholders who have suffered bodily injury or property damage from an auto accident that occurred on company property or with a company vehicle

- Auto insurance symbols include “Any Auto,” “Scheduled Autos,” “Hired Autos,” and “Non-Owned Autos.” “Any Auto” is most ideal because it means any vehicle the party drives will be covered.

- Umbrella & Excess Insurance:

- Excess Insurance: Does not expand policy terms, but includes higher coverage limits in case of unforeseen, catastrophic claims or loss

- Umbrella Insurance: A form of excess insurance that does expand policy terms and extends coverage to losses not outlined in the policy

- Workers’ Compensation & Employers Liability:

- Workers’ Compensation: Covers expenses resulting from workplace injuries, including medical care, lost wages, and rehabilitation

- Employers Liability: Pays for any lawsuits against employers resulting from employee injury or illness

- Other: Indicates if the named insured purchased other policies. This section is also where additional insured endorsements are listed.

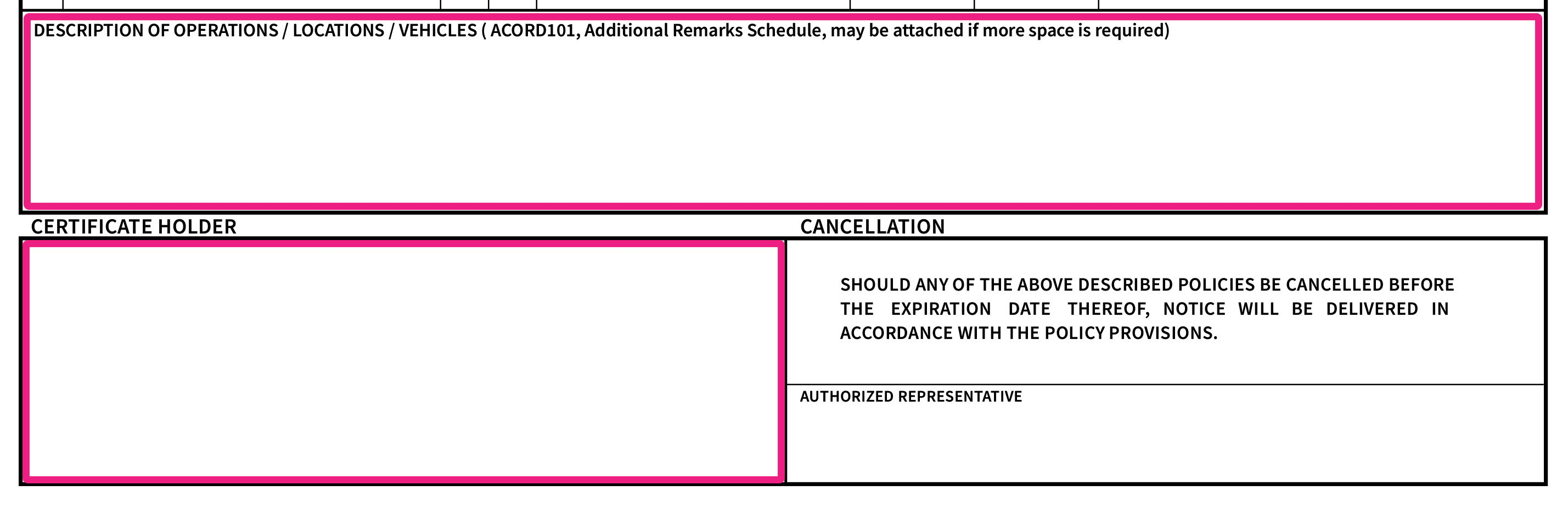

- Description of Operations/Locations/Vehicles/Exclusions Added by Endorsement/Special Provisions: Any special operations or job sites where work will take place. Additional insured endorsements are also listed here.

- Policy Number: The number assigned to the policy at the time it was issued

- Policy Effective Date: When a policy begins

- Policy Expiration Date: When a policy ends

- Certificate Holder: Entities a COI has been sent to or shared with

- Cancellation: The amount of notice an insurer will give the named insured if the policy is canceled before its expiration date

- Authorized Representative: Someone who has been given authority to sign the COI, whether an insurance agent, broker, or representative

What Are the Main Types of COIs

There are numerous types of certificates of insurance (COIs) to be aware of. Let’s break down three of the most common:

1. Certificates of Liability Insurance

Certificates of liability insurance verify the third party holds an active insurance policy in the event a business is sued.

This not only protects property owners, but extends additional insured status to the property manager or lender. Reviewing these documents is key for ensuring loss transfer from the project owner to a third party during a claim.

As you’re reviewing certificates of liability insurance, look for the following to verify coverage is adequate:

- Additional insured status is extended to the right parties.

- There is a description of operations for the project.

- It contains a waiver of subrogation.

- Coverage is primary and non-contributory.

2. Certificate of Workers Compensation Insurance

Certificates of workers compensation insurance prove coverage claims resulting from workplace injuries, including medical care, lost wages, and rehabilitation.

These are written and required based on each state’s specific requirements and laws.

3. Certificate of Auto Liability Insurance

Certificates of auto liability insurance verify insured status for bodily injury or property damage claims resulting from an auto accident on company property or with a company vehicle.

Track these for all vendor-owned, leased, non-owned, and hired vehicles.

Five Main Types of Insurance Policies

There are five main types of insurance policies listed on a COI, including:

- General Liability: Covers liability if a business is sued for incidents that occur on its property, during or after completed operations, or because of its products

- Automobile Liability: Insures policyholders who have suffered bodily injury or property damage from an auto accident that occurred on company property or with a company vehicle

- Workers’ Compensation: Pays for expenses resulting from workplace injuries, including medical care, lost wages, and rehabilitation

- Employers Liability: Covers employers in the event of lawsuits resulting from employee injury or illness

- Umbrella & Excess Insurance:

- Excess Insurance: Does not expand policy terms, but includes higher coverage limits in case of unforeseen, catastrophic claims or loss

- Umbrella Insurance: A form of excess insurance that does expand policy terms and coverage to losses not outlined in the initial policy

What Is a Certificate Holder?

A Certificate holders is an individual or organization that is named on a certificate of insurance (COI) as having an interest in the insurance coverage provided by the policy.

When an insurance policyholder (often a business or individual) obtains a COI from their insurance provider, they can choose one or more certificate holders. The certificate holders may include entities such as clients, customers, landlords, vendors, or other parties with whom the policyholder has a contractual or legal relationship. By naming these entities as certificate holders, the policyholder provides them with proof of insurance coverage and notifies them of the details of the insurance policy.

The certificate holder is typically entitled to receive information about the insurance coverage, such as the policy limits, effective dates, and types of coverage provided. In the event of a claim or potential liability, the certificate holder may also be notified by the insurance provider and may have certain rights or obligations outlined in the insurance policy.

In commercial real estate, a certificate holder might be the landlord or property manager.

Let’s say, for example, a kitchen cabinet subcontractor provides a business owner a copy of a COI to prove they are insured. The business owner would then be a certificate holder.

These people or organizations are typically listed in the bottom left box of a COI labeled “Certificate Holder” or in the “Description of Operations/Locations/Vehicles/Exclusions Added by Endorsement/Special Provisions.”

While the certificate holder may be informed in advance of any policy cancellations, they don’t receive any other benefits or protection.

To return to our previous example, the business owner wouldn’t receive any added coverage or benefits from the kitchen cabinet subcontractor’s policy by being a certificate holder; only the policyholder and any additional insureds do.

Certificate holder vs. Additional Insured

In short: An additional insured has access to your insurance coverage and can file a claim if needed, while a certificate holder is only informed about your coverage but cannot file a claim. In simple terms, the additional insured is protected by your policy, whereas the certificate holder is not.

For a deeper understanding of the distinctions between additional insureds, policyholders, and certificate holders, we invite you to watch the informative video below.

What is the difference between COI and insurance policy?

While insurance policies are comprehensive documents reflecting your contract’s terms, coverage, and limits, certificates of insurance (COIs) are condensed versions of insurance policies.

COIs contain only the most essential aspects of these contracts with your insurance provider, such as the policyholder's name, effective and expiration dates, type of coverage, limits, and carrier. They do not modify coverage or alter the terms of the policy.

For example, Paulina the Plumber is hired for a project in a skyrise by its property manager, Karl. To prove Paulina is insured, Karl asks her to provide a COI. While he doesn’t need the complete insurance policy, this abridged document verifies Paulina’s insured status so Karl can remain compliant.

It’s important to note that property owners and others requesting COIs do not receive additional policy benefits from it. Only if they are listed as additional insureds under these policies will coverage be extended to them in the event of a claim.

Is a Certificate of Insurance the Same as a Declaration Page?

No, a COI and a declaration page are not the same. A declaration page, commonly known as a “dec page,” is a section found at the beginning of your insurance policy. It outlines key details such as policyholder information, coverage limits, deductibles, and premium amounts. In contrast, certificates of insurance (COIs) provide a summarized proof of coverage, typically shared with third parties to demonstrate insurance status.

In a declaration page, you might find:

- Policy Information

- Personal Details

- Coverage Scope, Types & Cost

- Policy Limits

- Deductible

COIs are more condensed, and contain information about:

- Policyholder's Name

- Policy Effective & Expiration Dates

- Type of Coverage

- Limits

- Insurance Carrier

COIs are specifically crafted for insurance verification purposes. They are designed to provide hiring parties with essential information, without including extraneous details such as the amount a policyholder pays in monthly premiums. This ensures that the COIs offer precisely what is needed for verification without unnecessary clutter.

For example, If you’re pulled over, you wouldn’t give the officer a copy of your declaration page to prove you have an active auto policy. The same goes for third-party partnerships.

When determining whether you’ll work with a vendor, you would verify each other’s insured status using COIs. To send a copy of yours, request it from your insurer, who should provide one for free.

What Is the Difference Between a Binder & Certificate of Insurance?

A binder and a certificate of insurance are not interchangeable terms. A certificate of insurance serves as proof that you are covered by an insurance policy for a specified period. On the other hand, an insurance binder is a temporary document that provides immediate coverage while you await the issuance of your formal insurance policy. Think of an insurance binder as a placeholder policy that fills the gap until your permanent coverage takes effect. Once your formal policy is issued, the binder dissolves, and your permanent coverage takes over.This is particularly crucial because it can take insurance underwriters varying amounts of time—ranging from days to weeks—to finalize your policy.

To illustrate, consider the scenario of registering your vehicle at the DMV. You receive a temporary slip of paper as proof of registration until your official documents arrive. Similarly, an insurance binder serves as temporary proof of insurance during the interim period.

Key takeaway: While certificates of insurance offer comprehensive documentation of your policy, insurance binders provide essential coverage and proof of insurance in the short term, ensuring you remain protected until your formal policy is issued.

Why Are Certificates of Insurance Important?

A certificate of insurance (COI) serves as an important document issued by insurance companies or brokers, affirming the existence of an insurance policy. It plays a vital role for small business owners and contractors, providing essential protection against liability for workplace accidents or injuries, thereby enabling them to conduct business safely and responsibly.

Moreover, COIs serve as tangible proof of insurance coverage, whether in digital or printed format. However, their significance extends beyond mere documentation. Certificates of insurance are indispensable tools for demonstrating insured status, minimizing risks, and fostering secure partnerships. They encapsulate all the essential details of your insurance policy, serving as a comprehensive reference point for ensuring compliance and facilitating smoother business transactions.

Reasons COIs are important:

1. Proves Insured Status

A summary of the insurance policy, COIs verify insured status without the bulk of the document itself.

2. Provides Quick Access to Information

Rather than rifling through stacks of pages within an insurance contact, COIs are an express version that provides more convenient access to information.

3. Reduces Liability

By tracking COIs from all your third-party vendors, you can effectively transfer loss to their insurance carrier if something goes wrong.

4. Fosters Safe Partnerships

Vendor partnerships come with inherent risks, but by verifying each of their policies meets your requirements, you can mitigate non-compliance and build safer connections.

What Is the Purpose of a Certificate of Insurance?

While insurance policies contain information about your terms, coverage, and limits, certificates of insurance (COIs) are abridged documents reflecting the pertinent details of these policies.

Their main purpose is to provide proof of insured status.

When considering whether to do business with a third party, request a COI to verify their insured status, maintain compliance, and promote a safe partnership.

When to Ask for a Certificate of Insurance

Asking for a certificate of insurance is common in many business instances where one party wants assurance that another party has appropriate insurance coverage to protect against potential risks or liabilities.

Some common occurrences when a certificate of insurance is typically requested are:

- When entering into a new contract or work agreement with another company

- When hiring a new subcontractor

- When working with suppliers, vendors, or other third-parties

- When organizing an event

- Landlords often require tenants to have certain types of insurance coverage, such as general liability or property insurance.

- Lenders or financial institutions may require borrowers to maintain specific insurance coverage as a condition of a loan or financing agreement.

- In certain industries or when working on government contracts, certificates of insurance may be required to obtain permits or fulfill regulatory requirements.

When considering a new business contract with a third-party company, it's crucial to know when to ask for a Certificate of Insurance (COI). Always request a COI from a contractor before they commence work on your project. The COI should be obtained before entering into business with the new third party. Simply ask them to provide a copy from their insurance carrier, who should supply it for free. Anyone who is reluctant to do so could indicate there may be a deeper issue.

Requesting a certificate of insurance helps mitigate risks by ensuring that the other party has adequate insurance coverage to protect against potential losses or liabilities. It's essential to review the certificate carefully to verify that the coverage meets the requirements outlined in the agreement or contract.

How Long Should I Keep a COI?

It's recommended to keep a certificate of insurance (COI) indefinitely for any vendors or third-party companies you work with, even after its expiration date.

After a COI expires, it's beneficial to retain it as a record of when your vendors were insured by a specific policy. Although the coverage period ends, the liability for incidents during that time may persist long after the project's completion. By keeping expired COIs, you can effectively manage liabilities associated with past projects or engagements.It is common practice to retain vendor COIs for at least the duration of the contract or agreement, plus a reasonable period thereafter. The length of time you should keep your vendor’s Certificate of Insurance (COI) depends on various factors, including contractual agreements, industry standards, and potential liability risks.Your company’s COI retention practice should be adjusted to the unique circumstances of your business, contractual obligations, and risk management considerations. Additionally, consult legal or compliance professionals for guidance on document retention requirements specific to your jurisdiction and industry.

For example, let’s say Rudy the Contractor accidentally uses harmful materials on a construction job site, but its effects don’t show up for years. Luckily, Peter the Property Manager, a small business owner, has been tracking COIs with an automated platform. So, when visitors to the building begin developing side effects and sue his business, Peter is able to access a copy of their COI from that time period, mitigate his own liability, and ensure those affected are compensated with the proper insurance coverage.

Archiving COIs can also come in handy during labor disputes regarding health insurance provisions, paid time off, and more to help an organization prove a contractor was not a full-time employee at the time of the incident.

For these reasons, a robust COI tracking process should include not only monitoring coverage for ongoing projects, but archiving documents from completed ones.

How to Spot a Fake Certificate of Insurance:

Just because vendors submit a COI that appears to comply, doesn’t mean your business is completely protected.

Unfortunately, some contractors forge certificates of insurance (COIs) to make it seem as though they hold the appropriate policies.

Not only is this illegal, but failing to notice the telltale signs of a forged COI can make you liable for any damages the vendors cause.

Here’s how to spot a fake Certificate of Insurance:

- Missing Contact Information: COIs should include the insurer’s contact information, name, phone number, and address. Those that do not are likely forged, and designed to discourage you from contacting the carrier to verify its authenticity.

- Poor Quality: Most hard-copy certificates are printed at the broker’s office in response to direct requests, so those that appear to be photocopied or low quality should be investigated further.

- Inconsistent Font: Automated systems generate COIs with uniform fonts throughout. Inconsistent fonts, especially in the “Certificate Holder” and “Description of Operations/Locations/Vehicles/Exclusions Added by Endorsement/Special Provisions” sections could indicate forgery.

- Information Is Whited Out: Any information that’s been whited out has likely been inappropriately altered. Look for shadows and shading on photocopied documents to gauge whether it’s been tampered with.

What is COI Tracking?

COI tracking, or Certificate of Insurance tracking, is a process to manage and monitor certificates of insurance for any vendors, suppliers, subcontractors, or other third-party companies that your company does business with, to ensure they have valid and sufficient insurance.

Effective COI tracking helps businesses mitigate risks associated with third-party activities by ensuring that vendors and contractors maintain adequate insurance coverage. It also facilitates regulatory compliance, streamlines administrative processes, and enhances transparency and accountability in business relationships. Many businesses utilize specialized software or platforms designed for COI tracking to automate and streamline these processes.

What Makes a Good COI Tracking Process

Your COI tracking process can be tailored to your organization's unique requirements, bandwidth, and industry. To ensure effectiveness, all COI tracking processes should include at least these five steps:Collection: Obtain certificates of insurance from vendors, contractors, or other relevant parties before they commence work or provide services. Ensure all necessary documents are gathered and stored securely in a centralized location.

-

Verification: Review each COI to confirm that the coverage details meet the requirements specified in contracts, agreements, or internal policies. Verify that the insurance coverage is current, adequate, and includes any necessary endorsements or additional insureds.

- Expiration Monitoring: Implement a system to track the expiration dates of insurance policies listed on the COIs. Set up reminders or alerts to notify relevant stakeholders when policies are approaching expiration, facilitating timely follow-up and renewal efforts.

-

Renewal Management: Coordinate with vendors or contractors to obtain updated COIs as insurance policies are renewed or modified. Communicate any changes in insurance requirements and ensure compliance with contractual obligations throughout the renewal process.

-

Documentation and Record-Keeping: Maintain accurate records of all COIs and related correspondence, including renewal confirmations and any updates or changes to insurance coverage. Organize the documentation in a systematic manner to facilitate easy access, auditing, and reporting as needed.

By following these five basic steps, businesses can establish a structured and proactive COI tracking process to effectively manage insurance compliance, mitigate risks, and maintain transparency in their relationships with vendors and contractors.

For additional tips and a clearer understanding of the process, watch our informative video below to optimize your COI tracking efforts effectively.

How Does COI Tracking Actually Work?

Ensuring that Certificates of Insurance (COI) and other relevant insurance documents are up-to-date is crucial for reducing risks and adhering to regulatory requirements.

Despite the importance of maintaining current COIs, many businesses face significant challenges in effectively managing their insurance documentation. Shockingly, a recent report revealed that thirty-six percent of small businesses with directors and officers (D&O) liability coverage experienced a claim in the last two years, with an average cost around $120,000 and the highest in the millions.

Despite these alarming statistics, most companies don't have proper COI tracking protocols. And even among those that do, inefficient processes often overwhelm staff.

Having a well-defined process that’s transparent, supported by software, and updated as needed is key to any organization's success.

- Collection & Storage: Collect certificates from every third party and safely store them in a secure database or other location for easy maintenance.

- Analysis: Assess whether the terms and conditions meet your requirements, and monitor documents for any changes.

- Correction: If any information is inaccurate, contact the insurer to request an updated policy. We estimate seven out of 10 COIs are noncompliant, and require around three follow-ups to correct them.

- Follow Up: As policies may expire and vendors may switch insurers, it’s always a good idea to request the most updated information. Also, follow up before insurance renewals to prevent lapses in coverage.

To further enhance your understanding of COI tracking and implement these strategies effectively, we highly recommend watching our video on 'The Basics of COI Tracking.' In this video, we provide visual demonstrations and additional insights to help streamline your COI tracking process.

Why should I Track COIs?

Anyone who owns or operates a business, commercial property, or other site and works with third-party contractors should be tracking certificates of insurance (COIs).

These shortened documents reflecting all pertinent details of an insurance policy are key for reducing risks, ensuring compliance, and building safer business connections.

Depending on your company’s needs and bandwidth, you might choose to track COIs in-house or work with a team of insurance specialists. This is because tracking COIs is one of the most crucial aspects of any organization's risk management strategy. Let’s take a look at several key advantages of doing so:

Let’s take a look at several key advantages of doing so:

- Confirms vendor compliance with financial requirements

- Makes it easier to adjust claims in the event of a loss

- Minimizes insurance costs during audits and protects businesses against potentially millions in claims each year

- Ensures vendors are compliant and can continue working on job sites—improving productivity and project completion

- Minimizes coverage lapses via automated alerts about approaching policy end dates

- Provides valuable insights by highlight coverage gaps and centralizing data

- Mitigates evolving risks organizations face as vendors, project scopes, and conditions change over time

Should I Be Tracking COIs?

Anyone who owns or operates a business, commercial property, or other site and works with third-party contractors should be tracking certificates of insurance (COIs).

These abridged documents reflecting all pertinent details of an insurance policy are key for mitigating risks, ensuring compliance, and building safer business connections.

Depending on your company’s needs and bandwidth, you might choose to track COIs in-house or work with a team of insurance specialists.

Verifying COI Compliance

When tracking COIs to verify vendor compliance, it's crucial to consider various factors such as contract requirements, insurance policies, and regulatory standards.

While assigning a knowledgeable individual to oversee COI collection and review can streamline the process, some teams may lack the bandwidth for such tasks. In such cases, partnering with dedicated COI tracking analysts can be beneficial. This collaborative approach not only reduces the risk of non-compliance but also minimizes guesswork and potential claims issues.

Whether you’re utilizing an Excel template or integrated software, keep in mind the following questions to ensure you’re tracking COIs correctly:

- Is keeping this process internal saving my company money?

- Could our employees be better using their time to accomplish other projects and work that contributes to our bottom line?

- Do I know how compliant my vendors are?

- Do we have team members who are comfortable enough with insurance terminology to correct deficiencies and manage compliance?

- Will our current COI tracking process be able to accommodate hundreds or even thousands more vendors if the company grows?

Common COI Tracking Challenges

Whether you’re managing COIs in-house or working with a provider, COI tracking comes with a unique set of challenges. Let’s review them:

1. It’s time consuming.

There’s no way around it. COI tracking processes can be tedious and time-consuming, often involving:

- Requesting and following up with vendors to acquire documents

- Manual data entry

- Detailed analysis to ensure you’re fully protected

- Notifying tenants about cancellations or renewals to prevent policy lapse and ensure continuous coverage as policy scope changes

2. It can be more expensive than outsourcing.

Beyond the productivity hurdles involved with manual tracking, it can also be costly.

Instead of managing these processes in-house or hiring new staff, it is often more cost effective to work with a COI tracking company.

3. Risk analysis is complicated.

Once you compile the necessary COIs, then comes the complex process of analyzing and collating documents to assess and mitigate risks.

This can be challenging, and often requires input from someone with experience in insurance and compliance management.

4. Expertise is essential.

Not only does working with a COI tracking company help you navigate complex subjects, but it lightens your staff’s workload.

Instead of saddling your employees with insurance management—or, hiring new ones—working with a dedicated team of tracking specialists offloads these tasks so you can get back to focusing on your day to day.

Tracking COIs In-House

Tracking COIs in-house is accompanied by several important considerations.

Whether you’re utilizing an Excel template or integrated software, keep in mind the following questions to ensure you’re tracking COIs correctly:

- Is keeping this process internal saving my company money?

- Could our employees be better using their time to accomplish other projects and work that contributes to our bottom line?

- Do I know how compliant my vendors are?

- Do we have team members who are comfortable enough with insurance terminology to correct deficiencies and manage compliance?

- Will our current COI tracking process be able to accommodate hundreds or even thousands more vendors if the company grows?

If you’re tracking COIs in-house, consider using the following free resources:

- The International Risk Management Institute (IRMI)

- bcs University

- Email & Task Manager Platforms

- QuickBooks

- bcs's Certificate of Insurance Tracking Template

You can also try bcs's COI tracking software for FREE.

Working With a COI Tracking Company

While tracking COIs in-house might be a viable option for small businesses, growing companies can benefit in several ways from outsourcing these processes.

Working with a COI tracking company helps organizations:

- Leverage Dedicated Teams of Compliance Analysts

- Streamline COI Storage, Correction & Maintenance

- Offload Compliance Responsibilities

- Get Back to Running Their Business

Ultimately, the decision to offload these responsibilities usually depends on a few factors, including:

- The size of your company

- The availability of internal resources

- Knowledge and/or training of employees

- The number of vendors and contractors you work with

- The financial risks your vendors and contractors pose

Finding the Best COI Tracking Solution

If you decide to work with a COI tracking provider, the next question is: Do you need a full-service or self-service solution?

- Self-service tracking includes robust software your team can use to store, manage, and track COIs. However, while these intuitive platforms help streamline compliance and safeguard vendor information, they require staff to manage them.

- Full-service solutions come equipped with a team of insurance specialists to handle every facet of COI tracking for you. Along with the benefits of managing these processes in a secure environment, full-service tracking provides access to dedicated compliance expertise so you can free up your teams, mitigate risks, and enable projects to run smoothly.

To decide whether self- or full-service COI tracking is right for you, consider the following factors:

- Self Service:

- Small Businesses

- Low, Manageable Vendor Volume

- Sufficient In-House Insurance Knowledge

- Full Service:

- Medium-to-Large or Growing Businesses

- Large Vendor Volume

- Hands-On Approach & Expertise

Is There Free COI Tracking?

Businesses often seek cost-effective solutions to manage their COI tracking processes. While many may consider handling these tasks in-house to save on expenses, it's essential to recognize that no COI tracking solution is entirely free.

When managing COIs internally, team members must invest time and resources that could otherwise be allocated to revenue-generating activities. As companies grow and engage with more vendors, these tasks become increasingly time-consuming.

Outsourcing COI tracking to a dedicated solution incurs costs associated with software usage and access to expert support. However, to address the need for a budget-friendly option, we're excited to introduce our new Freemium version of COI tracking software.

Our Free Certificate of Insurance Tracking software, allows you to experience the benefits of our platform without immediate financial commitment. While the Freemium version provides valuable functionalities, such as COI tracking and vendor compliance management, it does have limitations, such as a restricted number of accounts or features.

We invite you to test our user-friendly COI tracking and vendor compliance software for free and discover how it can streamline your processes while ensuring compliance and mitigating risks. Take the first step toward improving your COI management today and experience the benefits firsthand.

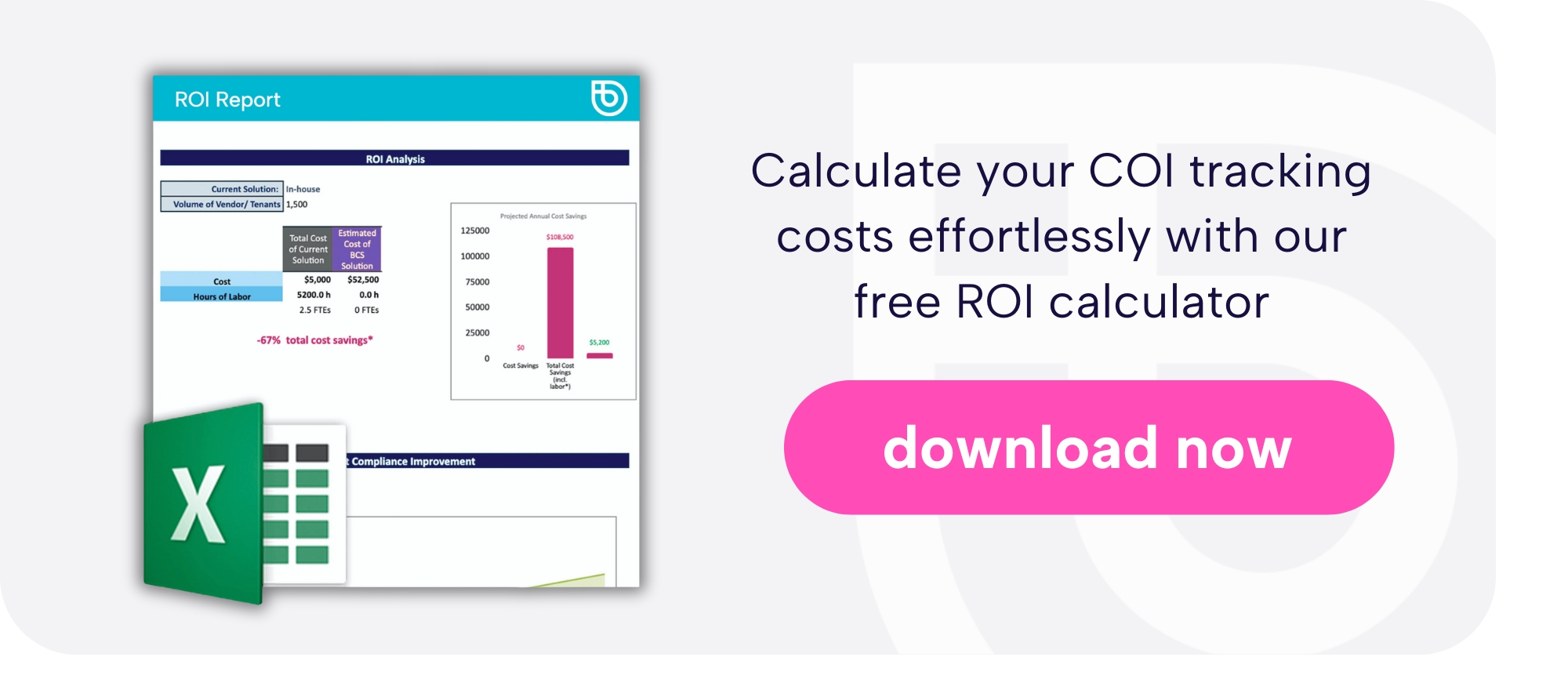

To determine how much your current COI tracking solution is costing you we encourage you to use our free ROI calculator tool.

To gauge how much your current solution is costing you, use our free ROI calculator tool.

In addition, there are several free tools you can use to support in-house tracking, including:

- The International Risk Management Institute (IRMI)

- bcs university

- Email & Task Manager Platforms

- QuickBooks

- Professionally-Made Spreadsheets

What Is COI Tracking Software?

COI tracking software is a specialized tool that helps businesses streamline the management of Certificate of Insurance (COI) documents. It centralizes COI data, automates tracking tasks, and ensures compliance with contractual and regulatory requirements. With this software, organizations can collect COIs, track expiration dates, verify coverage details, and receive automated notifications for renewals or updates.Some robust software enable you to easily chat with third parties, store documents, award bids to pre-vetted contractors and so much more—all from one integrated platform.

In summary, COI tracking software is vital for managing insurance effectively. It simplifies tasks, reduces risks, and helps ensure compliance. By automating processes, it makes managing insurance easier and more efficient.

As you're exploring software options, prioritize those offering the following features:

- Secure, Cloud-Based Storage: Look for solutions with secure, cloud-based storage for easy access to vendor assets and sensitive data protection.

- Automated Emails: Choose software that allows you to automate email creation and renewal messages, streamlining compliance processes.

- AI Software & OCR Scanning Tools: Opt for solutions equipped with AI software and OCR scanning tools to extract data from COIs, reducing manual tasks and improving project efficiency.

Additionally, consider not only modernizing your vendor management processes with the right software solution, but managing it through a COI tracking company.

With this combination of automation and expertise, you can minimize human error, save time and resources, and easily maintain compliance.

How Much Is COI Tracking Software?

Ultimately, the cost of COI tracking software varies by provider and service offerings.

For instance, bcs offers two solutions priced to suit different needs and budgets:

- Self-service tracking comes with a robust software platform that empowers your team to fully manage COI tracking in-house.

- Full-service solutions include a dedicated team of analysts to handle all your compliance needs.

As you’re deciding which option is right for you, consider your company’s requirements:

Self-Service |

Full-Service |

|

It comes with:

|

It comes with:

|

To gauge how much your current solution is costing you, use our free ROI calculator tool.

Excel Template vs. COI Tracking Software

If you’re opting for in-house tracking, the next question is: Should I use an excel template or COI tracking software?

- Manual Excel templates contain basic business information, COI expiration dates, compliance status, and other essential details.

- COI tracking software automates this information using a streamlined platform that sends compliance deficiency alerts, securely stores documents, and enables you to message vendors in real time.

While both can be managed in-house, COI tracking software requires far less manual upkeep, provides enhanced security, and streamlines compliance.

Automated COI tracking solutions such as bcs also include various capabilities, such as:

- Secure, Cloud-Based Storage

- AI Software & OCR Scanning Tools

- Onboarding Tools

- Automated Renewal Notices & Deficiency Alerts

- Pre-Qualified Vendor Database

- Request for Proposal (RFP) Automation

- Integrated bcs App

To learn more about both options, download our free COI tracking template or watch the bcs software demo.